Evolution of Digital Banking Security in Neobanks

The Shift in Banking Landscape

Gone are the days of endless paperwork and long queues in traditional banking. The advent of Neobanks has revolutionized the industry, offering a seamless and efficient banking experience through digital platforms. The market for Neobanks is on a steady rise, catering to customers’ needs for accessibility and convenience.

Cybersecurity Concerns in the Digital Era

As Neobanks gain popularity, concerns about cybersecurity and data protection have grown significantly. With cyber threats evolving rapidly, consumers are apprehensive about the safety of their sensitive information in the digital realm. The challenge lies in building trust among customers regarding the security measures implemented by Neobanks.

Security Measures Implemented by Neobanks

Neobanks have proactively addressed security challenges by leveraging technology to safeguard customer data. Measures include robust data encryption to protect information during transmission, multi-factor authentication for account access, and AI-powered fraud detection systems to detect suspicious activities in real-time. Additionally, partnerships with licensed banks ensure regulatory compliance and enhance security protocols.

Data Privacy and Transparency

Neobanks prioritize data privacy by adhering to government regulations and empowering customers with control over their personal information. Consent-based data sharing practices enable customers to make informed decisions about sharing their data. Transparent privacy policies further bolster trust by showcasing a commitment to responsible data handling.

Ensuring a Secure Banking Environment

While Neobanks offer advanced security features, customer vigilance is equally crucial in safeguarding accounts. By staying informed about security protocols, adopting best practices for online safety, and remaining vigilant against potential threats, consumers can mitigate risks and enjoy a secure banking experience, whether with Neobanks or traditional institutions.

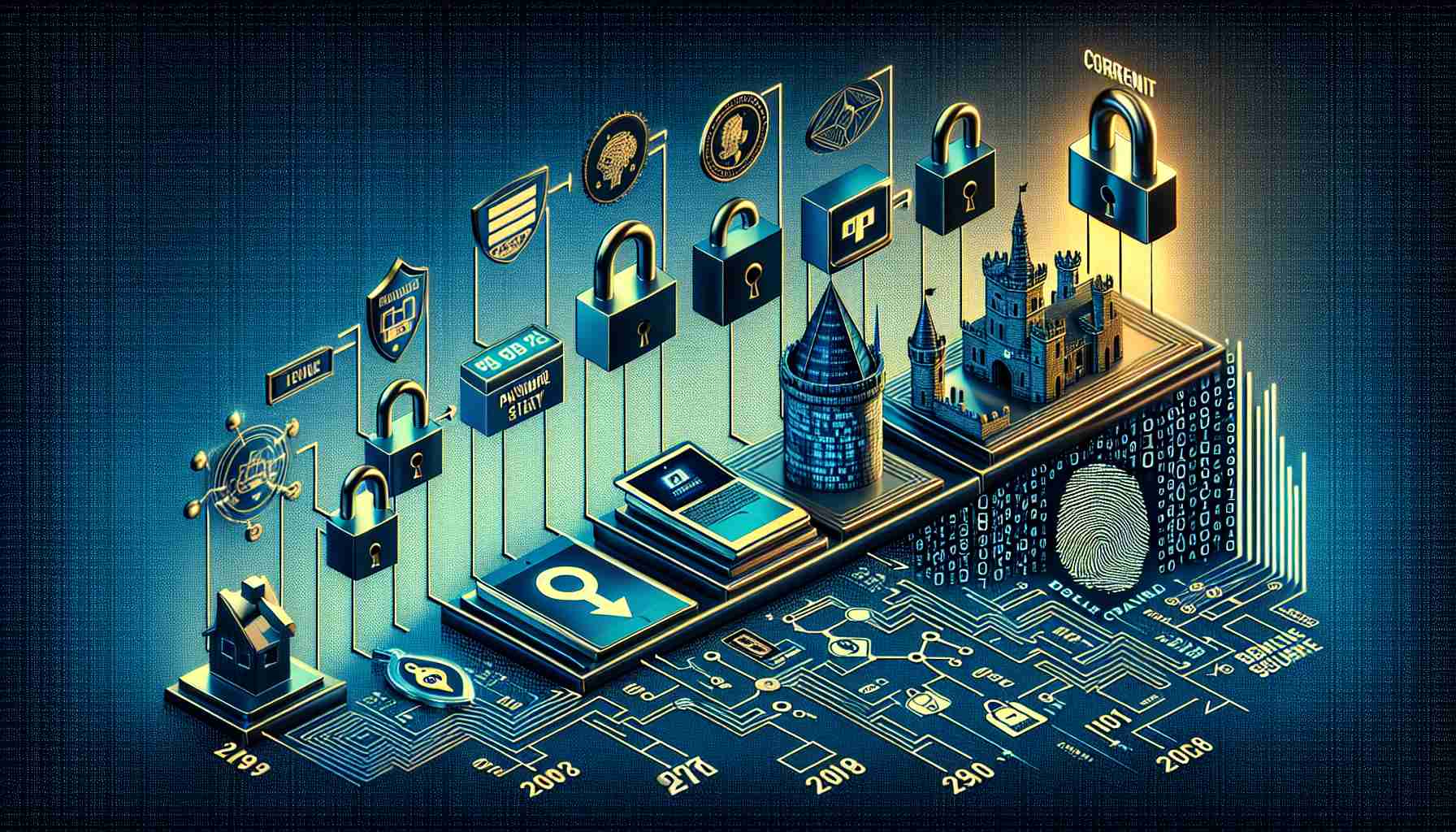

Advancements in Digital Banking Security in Neobanks

In the evolution of digital banking security within Neobanks, several key advancements and considerations have emerged that further shape the landscape of financial technology. While the previous article touched upon the importance of cybersecurity measures, additional factors contribute to the overall security posture of Neobanks.

Key Questions:

1. How are Neobanks adapting to emerging cyber threats and evolving security challenges?

2. What role does regulatory compliance play in shaping the security practices of Neobanks?

3. Are there specific technologies or innovations that Neobanks are leveraging to enhance data protection and customer security?

Key Advancements:

One notable advancement in digital banking security is the utilization of biometric authentication methods, such as fingerprint or facial recognition, to further enhance account access security. These advanced measures provide an additional layer of protection against unauthorized access attempts.

Furthermore, the implementation of machine learning algorithms and artificial intelligence in fraud detection systems has significantly bolstered Neobanks’ ability to detect and prevent fraudulent activities in real time. By leveraging these technologies, Neobanks can proactively identify suspicious patterns and promptly intervene to mitigate risks.

Key Challenges and Controversies:

One of the primary challenges facing Neobanks is the balance between robust security measures and seamless user experience. Implementing stringent security protocols may sometimes lead to increased friction in the customer onboarding process or during transactions, potentially impacting user satisfaction.

Additionally, the ongoing debate surrounding data ownership and privacy raises questions about how Neobanks handle and utilize customer data. Despite their commitment to transparency, concerns persist about the potential misuse or unauthorized access to sensitive information, highlighting the need for continuous oversight and accountability.

Advantages and Disadvantages:

Advantages:

– Enhanced convenience and accessibility for users through intuitive digital platforms

– Real-time monitoring and detection of fraudulent activities, improving overall security

– Empowerment of customers through data control and transparency measures

Disadvantages:

– Potential vulnerabilities in digital systems leading to data breaches or cyber attacks

– Balancing security measures with user experience may present usability challenges

– Regulatory complexities and compliance requirements can pose operational hurdles for Neobanks

In conclusion, the evolution of digital banking security in Neobanks continues to shape the financial services industry, with a focus on leveraging advanced technologies to ensure data protection and customer trust. By addressing key challenges and controversies while harnessing innovative security solutions, Neobanks can advance their competitive edge in the evolving landscape of digital banking.

Suggested Related Links:

Neobank Website

Banking Safety Resources